2025 Year-End Market Perspective: What Actually Changed

January 12, 2026

Executive Snapshot: What Changed in 2025

As 2025 comes to a close, one theme stands out across private equity and corporate environments alike: stability returned, but urgency did not. Market conditions improved, capital remained available, and deal activity recovered selectively. Yet the bar for execution rose materially.

Rather than chasing volume, organizations prioritized conviction. Rather than waiting for clarity, boards and sponsors moved earlier on leadership decisions. And rather than assuming short hold periods or rapid exits, many teams planned for longer cycles that demanded stronger operating discipline.

A few defining takeaways from the year:

Deal activity stabilized, but selectivity remained high, reinforcing the need for execution-ready leadership.

Capital became more disciplined and more concentrated, raising expectations for management teams.

Exit conditions improved unevenly, extending leadership time horizons and increasing pressure on succession planning.

Add-ons, carve-outs, and platform optimization drove complexity even without a surge in deal volume.

Leadership decisions increasingly moved earlier to protect value rather than correct underperformance.

Together, these dynamics reshaped how organizations approached leadership entering 2026.

Market Environment: Stability Without Urgency

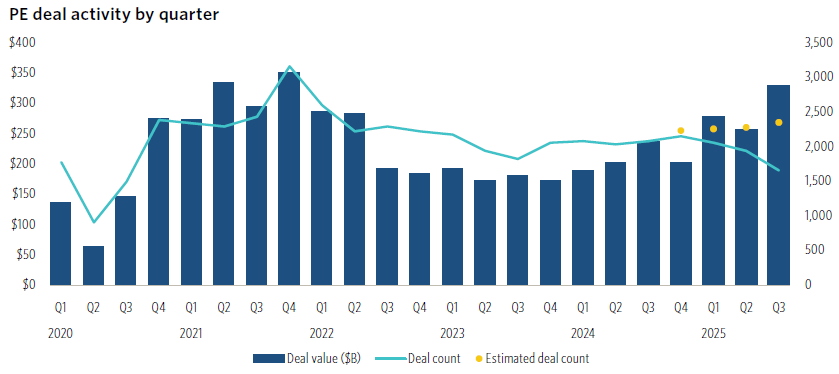

The second half of 2025 marked a meaningful shift from the volatility that defined prior years. Market sentiment improved, financing conditions became more supportive, and transaction activity resumed across a range of sectors. However, this recovery lacked the urgency and exuberance of prior cycles.

Deal activity returned in fits and starts. Sponsors and corporate acquirers alike became more comfortable moving forward, but confidence remained measured. Transactions that cleared the market tended to be well-underwritten, high-quality opportunities rather than speculative bets.

At the same time, the line between private equity and corporate behavior continued to blur. Corporate acquirers increasingly adopted portfolio-style thinking, while sponsors emphasized operational durability and long-term positioning over rapid financial engineering.

What mattered most was not speed, but readiness.

For leadership teams, this environment rewarded preparation. Organizations that entered the year with aligned leadership and clear operating cadence were able to move confidently. Those that waited for stronger signals often found themselves reacting later under tighter constraints.

Capital Dynamics: Discipline Became Structural

Capital dynamics in 2025 reinforced a longer-term shift toward discipline.

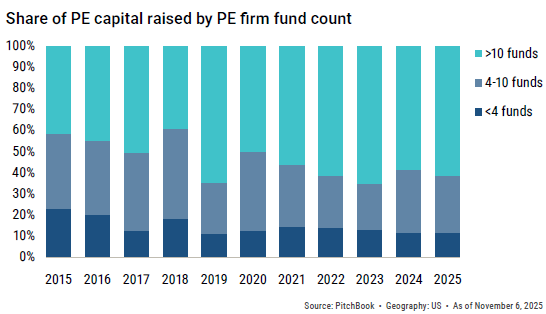

Fundraising slowed, distributions remained uneven, and limited partners concentrated commitments among fewer managers. While aggregate assets under management stayed elevated, capital formation became more selective, favoring firms with scale, track records, and operational credibility.

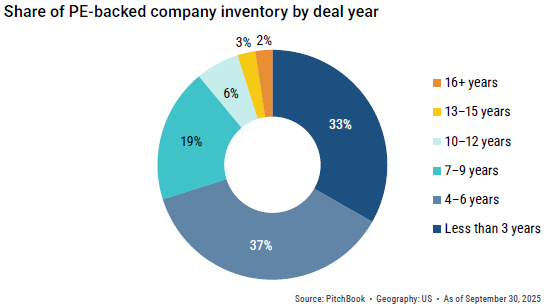

Longer holding periods increasingly became a planning assumption rather than an exception. Many assets aged into mid- and late-cycle phases while exit windows reopened only selectively. In response, sponsors and boards placed greater emphasis on leadership teams capable of sustaining performance over time.

For corporate organizations, similar dynamics emerged. Capital allocation decisions became more deliberate. Boards scrutinized leadership effectiveness more closely. And tolerance for misalignment narrowed as strategic initiatives competed for attention and resources.

Leadership implications were clear:

Less tolerance for leadership drift or learning curves

Higher expectations for CFOs, CEOs, and operating leaders

Earlier board involvement when execution risk surfaced

In this environment, leadership quality became a differentiator rather than a baseline requirement.

Deal Types That Drove Complexity (Not Just Volume)

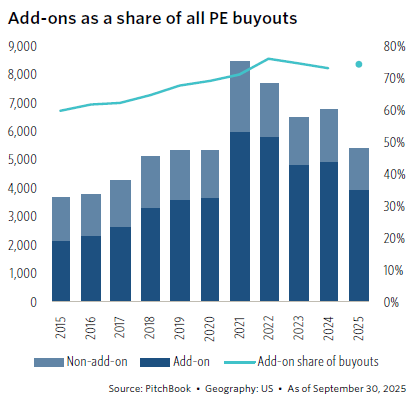

While deal volume did not surge, the nature of transactions in 2025 materially increased organizational complexity.

Add-ons remained a primary growth lever, placing sustained pressure on integration leadership. Carve-outs required stand-up teams capable of building independent operating infrastructure. Platform businesses shifted focus from acquisition to optimization, testing leadership depth and operating rhythm.

Founder-led organizations navigating institutional ownership transitions faced additional challenges. Informal decision-making models gave way to governance structures that required different leadership capabilities.

Across these scenarios, complexity accumulated even as transaction counts remained moderate.

The key takeaway:

The nature of deals mattered more than the number of deals.

Organizations that treated integration, governance, and execution as leadership disciplines navigated this complexity more effectively. Those that layered responsibility onto already-stretched teams often saw friction emerge earlier.

Exit Reality: Time Horizons Lengthened

Exit conditions improved in 2025, but unevenly.

A subset of high-quality assets achieved attractive outcomes, including renewed IPO activity and selective corporate acquisitions. At the same time, a large inventory of assets continued to age as sponsors exercised patience in pursuit of better conditions.

This dynamic extended leadership time horizons. CEOs were evaluated less on short-term acceleration and more on stamina. CFOs were expected to maintain transaction readiness over longer cycles. Boards moved succession discussions forward rather than deferring them to later stages.

Continuation vehicles, alternative liquidity structures, and partial exits became normalized tools within this environment. Rather than signaling distress, they reflected a pragmatic approach to value creation under constraint.

For leadership teams, the implication was straightforward: readiness mattered as much as timing

What This Meant for Leadership Decisions

Across 2025, leadership decisions increasingly shifted from reactive to proactive.

Rather than waiting for underperformance to surface, boards and sponsors intervened earlier to ensure alignment with strategic objectives. This trend cut across roles, with particular pressure on:

Chief Executive Officers, expected to align strategy, execution, and stakeholder communication from day one

Chief Financial Officers, tasked with guiding decision-making, capital planning, and transaction readiness over extended cycles

Operating and integration leaders, responsible for sustaining momentum amid continuous complexity

Leadership alignment emerged as a central value-creation lever. Teams with clear decision rights, operating cadence, and accountability moved faster and with greater confidence. Teams without alignment experienced decision latency, execution drift, and leadership fatigue.

Importantly, early leadership action was less about replacement and more about readiness. Organizations sought leaders equipped for what the business was becoming, not just what it had been.

What We’re Watching Entering 2026

As organizations plan for 2026, a few signals warrant close attention:

Leadership risk is increasingly underestimated in stable markets.

“Good enough” leadership breaks faster under sustained complexity.

Execution readiness often matters more than strategy refinement.

Boards that move early preserve optionality; those that wait compress it.

Markets may continue to evolve, but the organizations best positioned for the next cycle share a common trait: leadership teams aligned early around execution, not just ambition.

Closing Perspective

This year reinforced a simple truth. When markets stabilize, leadership matters more—not less.

As private equity and corporate environments converge around disciplined growth and longer time horizons, leadership decisions are moving earlier and carrying greater weight. Organizations that prioritize alignment and readiness are better positioned to protect value and move with confidence into 2026.

If it would be helpful to compare notes on how these dynamics are showing up in your organization, the conversation is always welcome.

Data Attribution

This perspective is informed by market data and research from PitchBook